The Western Australian Bank (1841 - 1927) Underwritten by Parochialism

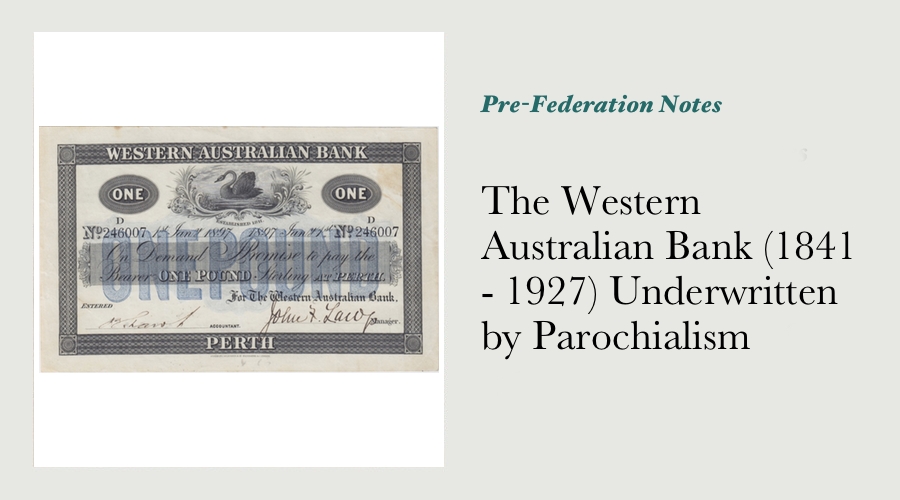

It is difficult to hold a banknote from the Western Australian Bank and not be taken back to the era it was issued in.

These large notes, with their intricate designs, calligraphed signatures and firm but undoubtedly fragile paper quality are objects of wealth unique to this part of the world, and evoke a long-distant era of formality and discipline. The Western Australian Bank merged with the Bank of New South Wales in 1927, and at it’s peak it was widely regarded as the most important commercial enterprise in Western Australia, one that “…had done more to assist in the development of mining in this state than nearly the whole of the other financial institutions combined.[1]”

The quality of a very small number of notes issued by the Western Australian Bank are regarded as among the finest Australian banknotes issued prior to Federation in any denomination, from any bank, in any part of Australia. They embody the drive to capture the abundant natural wealth in Australia’s western third, and are a reminder of a time when the leading financial institution in this part of our nation was founded, run and patronised by the people that lived and worked here.

Underwritten by Parochialism

The success of the Western Australian Bank was clearly underwritten by the parochialism for which many West Australians are renown, the causes of that parochialism commanded customer loyalty for many decades. Although it is hardly news that many residents of Australia’s most isolated state have long chosen to do business with their own over outsiders, the formative events that led to the dominance of the Western Australian Bank have not yet been widely discussed.

1832 - The Agricultural Society Requests £5,000

The first indication that a financial institution might be beneficial to the Swan River Colony was in 1832, when the Agricultural Society formally submitted a prospectus to Governor James Stirling for “an advance of £5,000 from the Treasury on the security of twenty-five responsible persons.”[2] Stirling denied the request, and stated “that the colonists should raise the money by private subscription.”

This rebuff, a result of policies set by the colonial authority located in distant London is a very early example of a remote governing body not sharing the same level of urgency regarding the availability of capital with those Western Australians who were living with the consequences of it. No doubt at least some of the colonists vowed to never allow themselves to be in this situation regarding their own finances again.

1833 - Colonial Secretary Peter Brown Issues £1 Notes

One author has stated that the result of Stirling’s urge for self-sufficiency was that the “Swan River Society” was formed out of the Agricultural Society in 1833 - each member was allocated 50 £1 promissory notes, and agreed to accept them in lieu of cash.[3]

For a period of time, these promissory £1 notes of the Swan River Society are believed to have performed their role as a medium of exchange well. Surviving examples of these notes have no mention of the “Swan River Society” on them, however several contemporary newspaper reports suggest that the notes were issued personally by the Colonial Secretary, Peter Brown.[4]

Brown was accused by another colonist of misusing the funds received from these notes, so Brown sued for slander, and won. A notice advising that the £1 notes were being recalled was advertised in November 1836.

1835 - John Wood’s Counterfeit Rupees

The popularity of the Swan River Society £1 notes apparently further eased once a number of Indian silver coins began to circulate throughout the colony. Within months however, it became apparent that these popular silver coins were in fact counterfeits, struck by a colonist (not a convict) who had bought up a large portion of the colony’s white metal, and had made them into crude rupees.[5]

The restrictions inherent in the Swan River Society notes, coupled with the threat to economic stability that the counterfeit rupees posed as well as a perceived disinterest on the part of the colonial authorities in London, both set the stage for the foundation of Western Australia’s first bank.

1837 - Bank of Western Australia

The Bank of Western Australia (1837 - 1841) was founded by George Leake, a leading merchant in the Swan River Colony of the time. The establishment of this bank was warmly welcomed in the colony’s newspaper: “It has been our ambition, for some few years, to obtain assistance from abroad, and many efforts were made; but we were not sufficiently advanced to effect it. At length from our own resources, it is accomplished. We heartily congratulate our brother colonists upon this bright feature in the annals of our colonial history.[6]”

The article in the Perth Gazette and Western Australian Journal reflected that since 1835, the Swan River Colony had become self-sufficient in “nearly all the articles of immediate necessity”. It commented that although a surplus of funds had been steadily accumulating in the two years since, “A large portion of these accumulations lie scattered and in a great degree, ineffective, in private hands. The operations of a well digested Banking System will consist in the collecting these scattered sums into one mass, and applying in, with concentrated force, to objects of private and public benefit. It will promote punctuality and confidence in our commercial transactions, domestic as well as foreign; at the same time that, by the circulation of the notes, and the assistance of its credits, it will give a more permanent standard of value to our possessions, in lands, houses, improvements, and every other description of property.[7]”

The civic nature of the new bank was emphasised several times, that the bank was “…founded on the broad basis of the whole community, the support which it claims is as universal as the benefits which it will bestow.[8]”

“…this long-desired object has been attained; and it must be a subject of congratulation to every one to know that it springs, not from foreign capital ingrafted in our native stock, or from artificial and premature schemes, but, naturally, from the gradual advancement of the Colony in prosperity, and the accumulation of capital…”[9]

“Here we have recorded the establishment of one of the most important institutions connected with our future prospects, and we are happy to say it exhibits a striking and faithful picture of our rapid progress, inasmuch as we find our accumulating capital, distributed in different hands, employed to the advancement of the general body.[10]”

Buoyed by these positive expectations, the Bank’s records show that it was able to obtain funds from local colonists, and was able to lend them out successfully. The Swan River Colony and the Bank prospered in the years that followed, however this convivial existence was interrupted when the Bank of Australasia (founded in London) announced it would open a branch. Following this news, Governor James Stirling arranged for a merger between the Bank of Australasia and the Bank of Western Australia.

As the Bank of Western Australia had been founded via a collective contribution of locally earned capital, for the benefit of the local community, the suggestion that foreign capital might be “ingrafted in our native stock” was not universally welcomed. Stirling asserted that the merger was to be “of much importance to the colony… for by its means settlers were calculated to obtain cheaper money.”[11]

Shareholders subsequently voted in agreement with this merger by the reasonably close margin of 57 to 51, this decision that did not sit well with number of the colony’s leading figures.

Western Australia’s first bank had survived as a sovereign entity for just 4 years.

1841 - Western Australian Bank

Shortly after the merger of the Bank of Western Australia and the Bank of Australasia, George Frederick Stone led a number of the 51 former shareholders of the Bank of Western Australia that had voted against the merger chose to establish another bank, named the Western Australian Bank.

Stone and others are said to have been “disgusted” with the decision to merge the Bank of WA with the Bank of Australasia, his prospectus denigrated the Bank of Australasia, and he exhorted local support because the new bank was local, with all the implications this carried.

The prospectus also carried some sting with the statement that it would be backed “by more influential and prosperous settlers…”[12]

The list of the people involved with the establishment of the Western Australian Bank does indeed include at least a good portion of “…the leading business, professional and colonial government section of the community[13]”:

George Frederick Stone; William Tanner; Richard Hinds; Edward Hammersley; Samuel Moore; Thomas Richard Carey Walters and W.J. Lawrence.

Of the directors and staff linked with the Bank of Western Australia, only one is also linked with the Western Australian Bank - Richard Hinds. Richard Hinds (senior) was a naval surgeon that arrived arrived in the Swan River Colony in 1837 on the ‘Shepherd’ with his wife Susannah and children Sarah and Richard.[14] This was the same ship that Edward Hammersley and his family arrived on. Hinds was the largest initial depositor at the Western Australian Bank. A number of the personalities associated with the establishment of the new bank also figure prominently in the government of Western Australia, showing that “the development of the Bank and the colony are connected.[15]”

1845 - Bank of Australasia Closes its Western Australian Branch

As soon as the Western Australian bank was established, it set about winning business from the Bank of Australasia by discounting its rates.

It received such strong support from local depositors that it forced the Bank of Australasia to shut down it’s branch in Western Australia after just 4 years of competition, indicating that the appeal of parochialism was a powerful one. At its worst, parochialism can be self-serving; short-sighted and unnecessarily conservative.

In contrast with Governor Stirling’s emphasis on the cost of money, the decision to establish the Western Australian Bank demonstrates that members of the Swan River Colony business community were more concerned about the local availability of money than they were with the cost at which that money might be borrowed - lending policies and the retention of surplus funds within the colony were more important to them than interest rates alone. The decision to support a local bank was intended to help ensure money remained available locally.

1845 - 1868 The Monopoly Years

The start of transportation of convicts to Western Australia in 1850 caused a fundamental shift in the Colony’s economic development.[16] Estimates of economic activity in the Colony, the size of Western Australia’s economy in 1860 was four times that in 1850.[17] With greater access to capital, the pearling and timber industries began to develop[18], while public expenditure on works, buildings and roads also increased. The assets of the Western Australian Bank slowly but surely grew during this period.

The National Bank of Australasia opened a branch in Perth in 1868 - its profitability and the optimism of it’s staff contrast greatly with that of the Western Australian Bank. ""The NBA sent its manager at Robe Town (South Australia) with £10,000 in coin, and instructions to compete fairly with the local bank, Law sailed around the barren coast to a colony that had no telegraph, no railway, and no feature of the industrial age of iron, except the leg-iron.[19]”

“The only surviving convict colony, perhaps half of Western Australia’s 20,000 people were convicts or ex-convicts in a gaol as large as India. Trade was sluggish, exports of wool and sandalwood were meagre, and the colony had only one bank, the local Western Australian Bank, which had opened in 1841 when Perth was a village. For the last twenty years the small bank had enjoyed a monopoly, simply because no bank thought the colony was worth entering.[20]”

Writing on the position of the National Bank of Australasia in 1871, the historian Geoffrey Blainey had to say this about the level of economic activity in Western Australia: “Western Australia was backward, and the new notes printed by the bank made this clear. The Victorian bank notes, in an ornate cameo, showed the face and shoulders of a contemporary damsel, clasping a long-tailed lamb. The South Australian notes depicted a coy girl with grapes in her long hair and a sheaf of wheat on her shoulder. The Western Australian notes showed a buxom girl, her chubby arms resting on the head of an axe, the symbol of a colony whose forests and deserts were imperfectly explored and whose commerce was more a venture in national development than in profitable banking.[21]”

If Blainey’s searing indictment of Western Australia as a place of commerce can be taken as an indication of external attitudes towards business in Western Australia, it is hardly surprising that some Western Australians might choose to do business with a local bank. In stark contrast, archival records of the Western Australian Bank show it was able to pay consistent dividends to its shareholders of 17.5% to 20% throughout its lifetime, regardless of whether economic conditions were favourable or unfavourable. Bonuses of £1 per £10 share were regularly given throughout the 1860’s and 1870’s, the bonus paid to shareholders in 1876 alone was £5 per £10 share[22] - just 5 years after the period that Blainey was commenting on.

1878 - 1890 Increased Competition and the Discovery of Gold

As the economy of colonial Western Australia expanded between the 1860’s and the 1880’s, a number of banks based either in London or the Eastern seaboard established branches in Perth.

The Union Bank of Australia opened a branch in Perth in 1878; the Bank of New South Wales opened a branch in 1883; the Commercial Bank of Australia opened a branch in 1888.

Despite this increased competition, the Western Australian Bank continued to pay strong dividends to shareholders, although arguably at the expense of market share. The loans made during the period 1861 to 1890 were mainly to pastoral concerns, road boards, municipalities, churches and societies[23] - by following that strategy, the Western Australian Bank remained tightly bound to the leading families in the colony. Edward Wittenoom received an overdraft for £3,000 for the leasing of White Peaks, and other such well-known pastoralists as the Padburys, Shentons, Lefroys, all received substantial aid for the development of the North—West properties, and for their businesses.

The discovery of gold in Halls Creek in the Kimberley region in 1886 was fundamental in shaping the economic and social landscape of the colony. News of the discovery travelled internationally and brought an unprecedented rush of immigrants and a level of economic growth previously unknown in the State.

Between 1890 and 1900, Western Australia’s population grew from 48,502 to 179,967.[24] Although the Halls Creek gold rush was short-lived, many prospectors stayed in Western Australia and explored other regions, culminating in the discovery of gold at Mt Charlotte near Kalgoorlie in 1893.

The story of the opening of the Coolgardie branch of the Western Australian Bank, as recounted in “Westralian Banker"" in September 1950, places a human face on the Western Australian Bank’s expansion during this period. “Mr Steuart was appointed manager and Mr. Sherwood the teller and accountant, the two set off for the goldfields with two outsized bullion boxes containing £10,000 in assorted notes and mixed coin, without any armed escort, and only carrying between them a six shooter to protect themselves and the money.

They went by rail to Northam, and by construction train to Burracoppin.

From there they travelled to Southern Cross by Cobb and Co. coach, it having taken them three days to travel 120 miles.

They slept in the open with the bullion boxes as a pillow. It took them six days to reach Coolgardie, to find that no bank was made and that there was nowhere to place the bullion.

Their average working hours per week were sixty to seventy hours, and they had to do this for no payment for overtime.

For eighteen months they all slept in the premises provided, with hessian and rough sawn timber camps, each accommodating two members- extra supplies later included camp stretchers, a wash stand, a basin and ewer, plus one gallon of water daily, which had to serve for drinking, washing and cooking.

Showers cost 1/6 each, and all that it consisted of was a water can being upturned over a person, the water being collected in a trough below and used again for the next customer.[25]”

To fully appreciate the level of trust placed in bank staff in this era, as well as the risks and sacrifices that they undertook, we need to remember that a week’s wages for the average worker at this time was slightly more than £2 per week, meaning that the amount of gold these men were responsible for could well equate to the total sum of money they would ever earn in their lifetimes. They needed to account for it down to the last penny, and protect it with just a single pistol between them. Given the sums of money involved, it is remarkable that more violent robberies didn’t take place.

1890 - 1910 The Banking Crisis and the Discovery of Gold

The discovery of gold in Western Australia occurred at around the same time a series of banking, currency and sovereign debt crises were unfolding around the world.

Following decades of strong economic growth, the Argentinean government defaulted on its sovereign debt in 1890, which caused what is now known as the Barings Crisis.

The British investment bank Barings was heavily exposed to Argentinean debt, and was only saved by the intervention of several other major investment banks in London, as well as the Bank of England.

The consequences of this crisis were felt right around the world, not least in Australia.

A strong boom in land values had been underway in Melbourne for some years by the 1890’s, under-pinned by loans made by the Australian banks, who had in turn borrowed cheap funds from British banks.

Following the Barings Crisis, those same British banks withdrew funds from Australia, which exposed many Australian banks to the lack of liquidity in their property loans.

By the time the 1893 banking crisis in Australia drew to a close, 11 banks across NSW, Queensland and Victoria had suspended operations and restructured.

This suspension had significant consequences for the lending policies of those banks in the years that followed. The Western Australian Bank’s business was entirely based in WA, so it was not exposed to losses on property caught up in the Victorian Land Boom. It was one of the very few banks in Australia that did not suspend during the 1893 financial crisis. One historian has stated that “One of the greatest factors in the growth in importance and in the regaining of the position of leading bank in the colony for the Western Australian Bank, was the occurrence of the Eastern banking disaster at a time when the colony of Western Australia was embarking on an era of growth and prosperity through the discovery of gold.[26]”

By 1903, the Western Australian Bank was represented by branches in the following locations:

Albany, Beverley, Black Arrow (Nunngarra), Boulder, Bridgetown, Cuballing, Broad Arrow, Bulong, Bunbury, Burthville, Busselton, Coolgardie, Cue, Day Dawn, Dongarra, Duketown, Esperance, Fremantle, Geraldton, Greenbushes, Guildford, Kalgoorlie, Kanowna, Katanning, Kooynie, Laverton, Lennonville, Leonora, Meekatharra, Mt. Morgan, Nannine, Narrogin, Newcastle, Norseman, Northman, Pingelly, Ravensthorpe, Southern Cross, Wagin, York and Gundamindera (The Granites).

One comment in the local press in this period captures the regard that many in the state had for the Western Australian Bank: “So far, nothing has contributed more to the Western Australian gold boom than the solid notes of the Western Australian Bank, and nothing will better support the gold boom in the future than those notes, which at any time may be paid in coin across the counter ten times over. The Western Australian Bank is indeed a model bank.[27]”

Gold yields had declined by the early 1900s, and agriculture overtook gold as the primary driver of economic growth. Historians have also recorded that during this period, the Western Australian Bank focused on lending money to pastoral and mercantile establishments that had sure security to offer, and made no attempt to assist small farmers become established.

Perhaps not without coincidence, the Forrest Government established the Agricultural Bank in 1895, which made loans to farmers up to £400 each. The Western Australian Bank became largely a trading bank for the large pastoral and mercantile concerns - they did business with the local aristocracy of the colony, the old established families of the state.[28]

1927 - Amalgamation with the Bank of New South Wales

Amalgamation in the Australian banking industry had been taking place since the 1890’s, larger banks were better equipped to deal with the lack of liquidity inherent in long-term loans, and did not have their risk geographically concentrated.

The notion of the Western Australian Bank becoming part of a larger organisation was first raised in 1914, following a severe drought in Western Australia that impacted a number of agricultural loans.

A further decline in the pastoral industry in 1919 saw the idea of amalgamation raised again, however this was not pursued.

The Bank of New South Wales made it’s first “tentative and informal approach” to acquire the bank in 1924, the first formal offer was made in January 1927.

An article in the Argus newspaper in Melbourne announced on January 28th 1927 that the Western Australian Bank had been absorbed by the Bank of New South Wales for a sum of £1,900,000.

At that time, the WA bank had 84 branches and sub-branches in Western Australia. Amalgamation with the Bank of New South Wales was complete by March 29th, 1927, which brought to an end a local institution “that had so long identified with the life and fortunes of this state.[29]”

Historians have stated that even though the public was not notified of the merger until February 1927, “…little public concern was shown at the time of the amalgamation.[30]”

The primary benefit of amalgamating with a bank that had national scope was that “…it should theoretically bring extra available capital to the state.[31]”

In the decades since 1841, Western Australia had become far less isolated from the commercial centres of Australia’s Eastern seaboard than it had been, meaning that simply being parochial was not as pragmatic as it once was. “To new immigrants, the Bank was just a bank and no patriotism could be felt for it. It certainly had done little to aid these new settlers in their attempt to farm the Eastern Wheatbelt areas, and probably they thought the Bank to be concerned only with the large pastoralists and business houses.[32]”

Although several emotive pleas were published in the WA press arguing against the merger, the bank’s management did not make any public comment on the proposal prior to the vote being put to shareholders.

After the decision had been made, an article in the West Australian newspaper stated “There was the feeling that the volume of deposits requisite to enable it to cover the vast field open to it in the matter of sound advances for developmental purposes were insufficient to the local bank. Western Australia is young industrially, and has no considerable capital accumulation, and the rapid expansion of agricultural and pastoral industries and commerce has created opportunities for the profitable utilisation of capital which can not be met unless a considerable portion of that capital is drawn from resources without the state.[33]""

“…a bank which although it figured prominently in Western Australia up to its amalgamation with the Bank of New South Wales in 1927, has completely vanished from the local scene. With it has gone many memories of its valiant efforts to help the growth of the colony with financial aid to such industries as timber, pearling, fruit and gold in their early development.[34]”

A number of buildings built in the early 1900’s that housed branches of the Western Australian Bank remain standing to this day, and have been preserved for their heritage value. Far fewer notes of the Western Australian Bank are available to collector - these large notes, with their intricate designs, calligraphed signatures and firm but undoubtedly fragile paper quality are objects of wealth unique to this part of the world, and evoke a long-distant era of formality and discipline.

The Banknotes of the Western Australian Bank

Type One (24/6/1841 - 24/2/1844)

The first series of notes issued by the Bank of WA were printed in black ink on the front only, by a printer in the Swan River Colony itself. They measure 183 * 102mm, the paper stock was extremely light, even when compared to other notes from the pre-federation period. 4,000 of these notes had been issued by January 1844.

A small batch of several hundred unissued examples of these notes were discovered in the early 1980’s, and were marketed by the coin dealers Downies. These unissued £1 notes were presented in a coloured cardboard album that contained a range of background information on the bank and the note, and was decorated by a number of contemporary watercolours of the Swan River Colony.

Downies’ marketing literature for the notes stated that “From records, it is possible that up to 650 of these notes exist in original and uncancelled condition. However, experts believe the number surviving may well be as little as half of that number.[1]”

Type Two (24/2/1844 - 1/11/1860)

Mick Vort-Ronald writes that “At the WA Bank’s half-yearly meeting of January 10th, 1844, the Bank’s directors announced that “A supply of new Notes, of a more durable character and from an engraved plate, is also daily expected, to supersede the neat but temporary note in type, which has hitherto been in circulation.” These “Type Two” notes were engraved outside WA, and featured an oval containing a swan on the front at top centre, the title of the bank and “Established 1841”. The name of the bank is in the top and bottom borders, “Perth” is in the side borders. The back of these notes were also blank.[2]” No notes of this type have ever been sighted, either in a public collection or in private hands.

Type Three A (1/1/1861 - 1866)

Mick Vort-Ronald’s research on these notes indicates that they have the following specifications: “Large swan at top centre on the front, surrounded by ornamental leaf design. ""White line"" straight border, with title of bank in top border, and ""Perth"" in bottom border. Denomination in a medallion either side of the swan. Front printed in black only. Serial numbers A 1 to A 20000.[3]” No notes of this type have ever been sighted, either in a public collection or in private hands.

Type Three B (1866 - 1/7/1878)

These notes measure 190 * 113mm, and have the same basic design as Type 3A. They also feature “WAB” in large coloured letters in the centre of the front of the note, and are known to have been engraved by Charles Skipper & East, London. Just one issued note of this type has been sighted so far in private hands.

Type Three C (1/1/1879 - 1909)

These notes measure 185 * 114mm, the designs are largely the same as Type 3B, they were printed by Bradbury Wilkinson & Co. in London. The large “WAB” in the middle of the front of the note has been replaced by the denomination in large sans-serif letters in blue ink. The designs on the back of the note are in blue - it features the denomination figure in the centre, surrounded by geometric ""white line"" design. The serial number range for these notes is from B 00001 through to D 725000, they were last issued in 1909.

It is believed that at least 3 or 4 of these notes (this note among them) were originally held in the archives of the Western Australian Bank, and were retained after the Commonwealth Government assumed authority over Australia’s note issue in 1910.

The Western Australian Bank amalgamated with the Bank of New South Wales in 1927, and the archives of the Western Australian Bank were transferred to the archives of the Bank of New South Wales in the years that followed.

Today, the Westpac Museum is located at Playfair Street in the Rocks, it houses a display that “traces the history of banking from as early as Australia's colonisation in 1788, to current day banking and finance trends.[4]”

The Westpac Museum was established at the current site in the mid 1980’s, and it is understood that a number of items were divested from the Bank’s archives in order to fund acquisitions of other items required to present a comprehensive display of banking history.

Not only do these notes from the Western Australian Bank remain in incredible quality relative to nearly all the other Australian banknotes issued prior to 1910, they have an impeccable provenance.

1. Greenhill; C, ""The Western Australian Bank, 1841-1927 : an historico-economic research of Western Australia's only private local banking institution"" in the University of Western Australia Thesis, 1959, p102 p ↩

2. Greenhill p12 ↩

3. Greenhill p12 ↩

4. http://www.wanowandthen.com/Peter-Brown.html ↩

5. Perth Gazette and Western Australian Journal (WA : 1833 - 1847), Saturday 28 November 1835, page 606 ↩

6. Perth Gazette and Western Australian Journal (WA : 1833 - 1847), Saturday 20 May 1837, page 904 ↩

7. Perth Gazette and Western Australian Journal (WA : 1833 - 1847), Saturday 20 May 1837, page 904 ↩

8. Perth Gazette and Western Australian Journal (WA : 1833 - 1847), Saturday 20 May 1837, page 904 ↩

9. Perth Gazette and Western Australian Journal (WA : 1833 - 1847), Saturday 20 May 1837, page 904 ↩

10. Perth Gazette and Western Australian Journal (WA : 1833 - 1847), Saturday 20 May 1837, page 904 ↩

11. https://en.wikisource.org/wiki/History_of_West_Australia/Chapter_13 ↩

12. Greenhill, p24 ↩

13. Greenhill, p51 ↩

14. https://www0.landgate.wa.gov.au/maps-and-imagery/wa-geographic-names/name-history/historical-suburb-names ↩

15. Greenhill, p1 ↩

16. “An Economic History Of Western Australia Since Colonial Settlement”, WA Department of Treasury and Finance, Perth, 2004, p 7. ↩

17. “An Economic History Of Western Australia Since Colonial Settlement”, WA Department of Treasury and Finance, Perth, 2004, p 8. ↩

18. “An Economic History Of Western Australia Since Colonial Settlement”, WA Department of Treasury and Finance, Perth, 2004, p 7 ↩

19. Blainey & Hutton; Geoffrey & Geoffrey, “Gold and Paper (1858 - 1982)”, Macmillan, Melbourne, 1983, p 49. ↩

20. Blainey & Hutton; Geoffrey & Geoffrey, “Gold and Paper (1858 - 1982)”, Macmillan, Melbourne, 1983, p 49. ↩

21. Ibid, p50. ↩

22. Greenhill, p4 ↩

23. Greenhill, p69 ↩

24. ABS, 2004 ↩

25. Westralian Banker, 1950 ↩

26. Greenhill, p94 ↩

27. Financial Post, 9/10/1895 ↩

28. Greenhill, p102 ↩

29. Greenhill, p3 ↩

30. Greenhill, p4 ↩

31. Greenhill, p130 ↩

32. Greenhill, p137 ↩

33. “Western Australian Newspaper”, February 21st 1927, p 6. ↩

34. Greenhill, p3 ↩

[1] Australian Coin Review

[2] Vort-Ronald; Mick, ""Banks of Issue in Australia"", Self-Published, Adelaide, 1982, p 236.

[3] Vort-Ronald; Mick, ""Banks of Issue in Australia"", Self-Published, Adelaide, 1982, p 236.

[4] http://www.environment.nsw.gov.au/heritageapp/ViewHeritageItemDetails.aspx?ID=5053229