Just How Accurate Is the PCGS Population As A Guide to the Rarity of a Coin?

This article is going to be something of a work in progress - the subject matter is one that hasn’t yet been widely discussed in Australia, however I believe it’s an important one to get started. It is a subject that collectors in the US grapple with from time to time.

For those of you that aren’t aware, the Professional Coin Grading Service (PCGS) is now a rather popular service used by collectors in Australia - coins sent to this company are independently assessed for their authenticity and condition, with the number of each coin sighted recorded and displayed in The PCGS Population Report on the PCGS website.

This “Population Report” is used by many collectors (myself included) as a further indicator of rarity that goes above and beyond the knowledge gained from assessing a mintage figure.

My thoughts are that the PCGS population is a useful proxy for the market rarity of a coin - the number of coins that actually exist, and the number of coins that are available to collectors on the open market. I’ve been using the PCGS population to try and identify coins that may either be rarer than their mintage or catalogue value might suggest, something that is a very interesting exercise indeed.

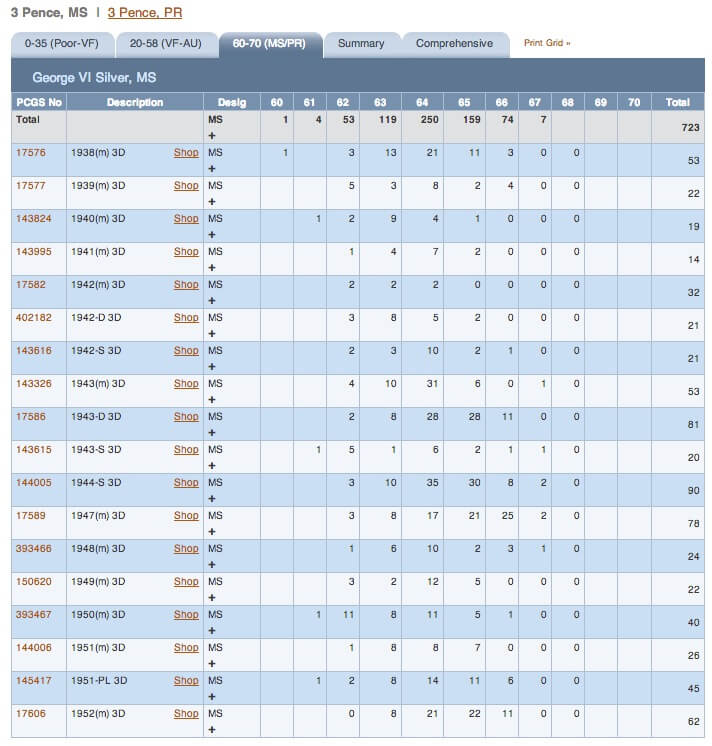

As an indication, here is a screenshot of the current population of the King George VI threepences in mint state:

I look at that information and can see that the pretty significant difference between the population of the 1941 threepence and the 1947 threepence (14 and 78 coins graded respectively) doesn’t align with the difference in catalogue values that these coins presently have ($95 and $150 respectively in UNC).

As PCGS has been on the Australian numismatic scene in a reasonable way for 3–4 years now, I’ve had the opinion that the PCGS population of certain coins would be a more accurate indicator of their market rarity than the prevailing opinions based on mintage figures and catalogue values. Working on this assumption, I'm keen on coins such as the 1941 3d identified above, that appear to be inexpensive relative to coins with a higher catalogue value and also a higher PCGS population.

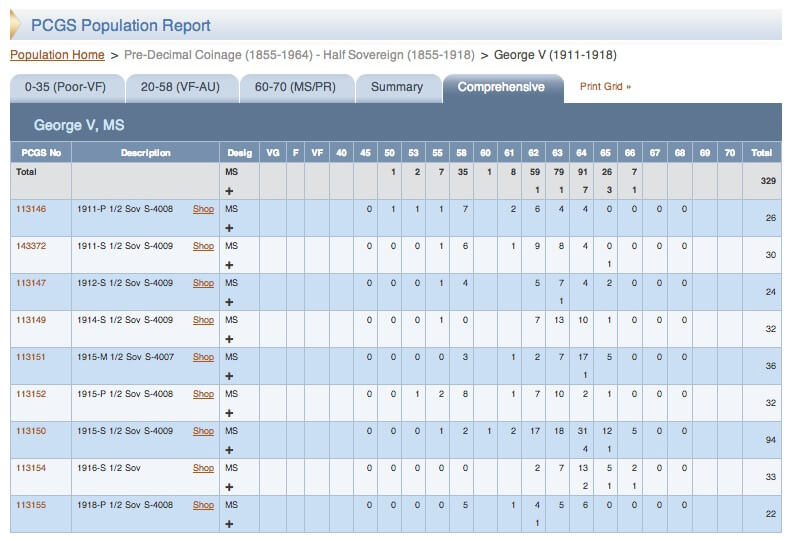

Assessing the PCGS population for another relatively short series of Australian coins has me question whether this conclusion is entirely correct however. Exhibit B here is the current PCGS population for the half sovereigns of King George V:

The two coins I’m looking at here are the 1912 Sydney and the 1918 Perth, with a population of 24 coins and 22 coins respectively. The 1918 Perth is easily the key date to this set, and has a current catalogue value of $9,500 in UNC, whereas the 1912 Sydney is considered to be far more readily available and has a catalogue value of just $525 in the same grade.

There are a number of presently-unconfirmed stories that the entire mintage of the 1918 Perth half sovereign was exported to India, and as a result it wouldn't be completely out of this world for a small hoard of them to be discovered, and to then make their way onto the collector market.

That said, I don’t yet accept that the PCGS population for the 1918 Perth half sovereign is an accurate reflection of it’s rarity, relative to other Australian half sovereigns anyway.

If you click through using the links below, you’ll see that the 1918-Perth half sovereign actually has a higher PCGS population than any other Australian half sovereign dated earlier than 1911 (apart from the 1856 half sovereign):

Australian Half Sovereigns Issued Under Queen Victoria

Australian Half Sovereigns Issued Under King Edward VII

If we were to accept that the PCGS population was indeed a razor-sharp accurate guide to the rarity of a coin, it would mean that the 1918-P is far more readily available than nearly all Australian sovereign issued between 1857 and 1910, an argument that even the most ardent devotee of the PCGS system would have to agree is unlikely to stand up to the test of time.

Such a conclusion doesn’t explain how this anomolous situation has come about however - just why is the population of the 1918-P so high relative to other dates?

There is little doubt that increasing numbers of Australian collectors are turning to PCGS to get a clear idea of where the grade of their coins sits in relation to others that are known to exist. I believe the “early adopters” of the PCGS grading system tend to be younger than average, and further the members of this generation that are interested in half sovereigns have more often than not embarked on collecting half sovereigns by acquiring coins in the KGV series in mint state first, rather than getting earlier and more historic coins.

The 1918 Perth has easily been the most keenly sought Australian half sovereign for a few years now, largely because it is the key date in what is otherwise such an accessible series, keenly built by younger than average collectors. Couple all these informal observations together and you get what I believe is a rather disproportionate number of coins of that date having been submitted to PCGS for grading.

Auction records are yet another means by which collectors (incuding myself!) obtain a proxy idea of the rarity of a coin. My study of auction records over the past few years reminds me that I’ve only seen one (raw or unslabbed) 1918-P in what I’d describe as unimpaired mint state (MS62) in the past two years, as wellas one other raw coin that I assessed as Choice Uncirculated (MS 63). While these coins may well have been adjudged by PCGS as being a point or two either side of my own estimates, I believe the auction records show that although an unforseen number of 1918-P half sovereigns may well have been graded by PCGS in recent months, these coins aren’t making their way onto the open market in any way, much less at discounted prices.

I’m interested to hear how you use the PCGS population report to assess market rarity, or auction estimates, or mintage figures, or even catalogue values.

Are they finally an unbiased view of rarity, or do they really need to be taken in context of the other data that is available? At this stage, I believe the latter is the case.