NGC or PCGS - Which is the Benchmark Grading Service in Australia at Present?

A recent online auction by Universal Coins most likely answered this very question, however before I get into a discussion of it, let me start by saying that it’s a reflection of the transparency that the internet has brought us in the 21st century that questions like this are even asked, let alone answered.

You can bet your bottom dollar that market participants (whether they be collectors, dealers, suppliers, auction houses) were not discussed to the same degree as we’re going to get into here even a decade ago - you might have had the odd letter to the editor of the Coin Review or the CAB magazine, collectors and dealers would grumble / skite / crow / complain when they met up at a show or auction, however that’d be it. Online forums etc allow all of us today to really explore factors at play in the numismatic market not just as individuals, but as a group.

As numismatic grading services didn’t really get taken up by mainstream collectors in Australia until just a few years ago, comparisons like this could hardly be made prior to that, however I see a paralell between the recent Universal auction (and the relative appeal of both grading services), and the way banknotes were often traded back in the boom days of the last market.

Check auction records over the past 10–20 years, and you’ll see it wasn’t unusual for a number of banknotes to go from one auction house to another within the space of a few months, and to go from one grade / description and value, to another. That wasn’t necessarily nefarious behaviour by any means, but it really did show just how much value one market participant could bring relative to another.

Anyone that has reviewed Mick Vort-Ronald’s books covering auction records for Australian banknotes will have seen this happen time and again, however it’s fair to say there hasn’t been much discussion of it in an open forum.

The ability of some market participants to bring greater value to the table than others can now be seen easily in a public way, this is very new for a market that has been notoriously opaque up until recent times.

The reason the recent Universal Coin auction is of interest, is that it included a range of coins that had been offered for sale in the Benchmark Collection, auctioned by International Auction Galleries just a few months earlier. While it’s quite normal for inventory to move from dealer to collector, to auction house to dealer to collector, I’d assert that it isn’t “normal” for coins to sell for exponentially more in one venue than another within a short space of time - particularly when everyone involved can see it all happening in plain view!

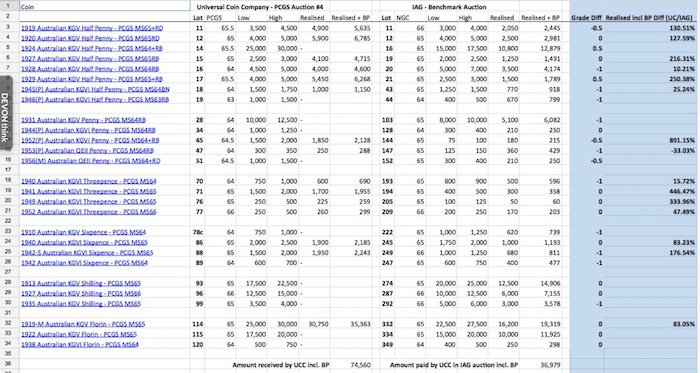

Click this link to cast an eye out over a Google Docs spreadsheet prepared by a dedicated collector that took the time to really dig deep into this whole subject, then shared it in the major coin forum for coin geeks in Australia:

You’ll see a list of coins that were in the Benchmark sale by IAG - the lot number, NGC grade, estimate and hammer price. You’ll also see the grades that these very same coins were assigned by PCGS, and the figures they then achieved via the Universal auction once graded.

Make no mistake, not all of the coins sold, however a number of coins made considerably more once they’d been PCGS graded. I don’t believe this reflects at all on the relative merits of either auction house - they both use basically (basically) the same technology, and have access to basically (basically) the same customer base. All things being equal, I believe the results reflect the role that PCGS plays in the collections of many Australian collectors these days. Does it reflect their confidence in the grading standard of PCGS relative to NGC? Perhaps, and most certainly initially it did. I reckon now that many collectors are participating in the PCGS registry set program as a means of recording their collections, it is more a case of whether a coin can be added to a PCGS registry set, and how many points that coin contributes to that registry set that is a key determinant of value.

The Benchmark coins sold by Universal were exactly the same as they were just a few months earlier, however the same collectors that were keen participants in that auction left the very same coins alone just a few months earlier, as they couldn’t be included in PCGS registry sets (despite their indisputable superior quality and esteemed provenance).

Dealers and collectors have been submitting raw and NGC-graded coins with unremitting regularity to PCGS since they took hold just a few years ago. Not since the Borg collection was sold by Pacific Rim Coins back in 2012 has there been an unequivocal example of the value that PCGS’s grading and registry set program can add to a coin or collection.

On that basis - is PCGS the “Benchmark” grading service in Australia at present?