Australia’s Superscribed Banknotes - Issued By The People, For The People

To many collectors, 2013 marks a hundred years since Australia’s first notes were issued. The “Treasury” series of Commonwealth notes have long been regarded by the vast majority of Australian note collectors as the first notes issued by Australia’s Commonwealth government.

Knowledgable collectors are aware that the Treasury notes are not the first - the Type I superscribed notes that were issued from 1910 is the first series of Australian notes issued under the authority of the Commonwealth government.

Our superscribed series notes are misunderstood and under-appreciated by the majority of Australian note collectors for a number of reasons:

- Their appearance is very similar to the pre-federation notes they replaced;

- It is an incredibly complex series to fully comprehend;

- They have not been comprehensively catalogued by the popular price guides for a number of years;

- Very few collectors appreciate that the superscribed notes circulated alongside the Treasury notes for a short period of time; and

- The reasons why the Commonwealth Government assumed control of the issue of notes are not widely known.

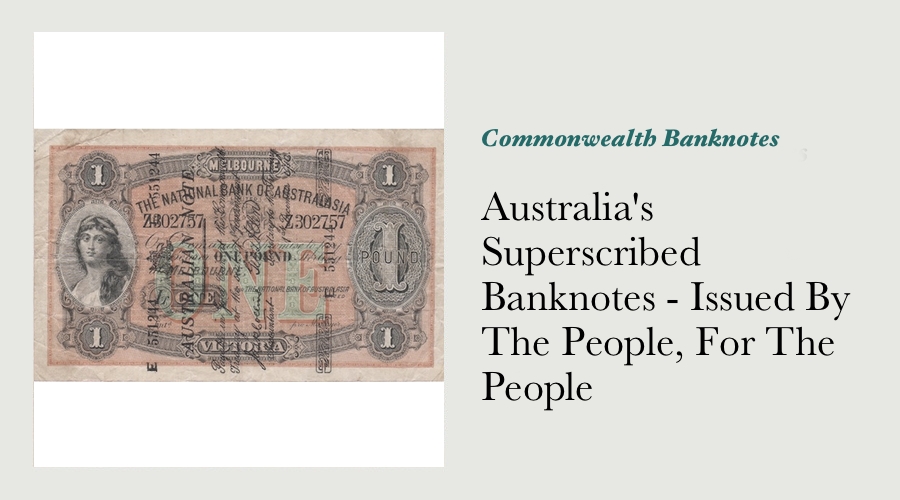

Very Similar In Appearance to the Pre-Federation Notes They Replaced

In the foreword to his catalogue of Australian notes, Hagley explicitly states that it was “a simplified catalogue…on the discinctive notes issued under the Bank Notes Act, 1910, and subsequent amendments to this Act.” About the superscribed notes, Hagley specifically stated that “these over-printed (so-called superscribed) notes, although issued under the authority of the Act, are omitted here as this listing is designed to cover only government notes of distinctive design.”

Although the superscribed notes do indeed look quite similar to the pre-federation notes that preceded them, to my mind they are far too important both from an economic and numismatic perspective to be omitted from any collection of pre-decimal notes, much less omitted from the catalogues that most Australian note collectors use to define the parameters of their collection.

A Complex Series of Notes

The superscribed series of notes is incredibly complex - Dr Alan Nicholson, in the second (1979) edition of his landmark work, “Australian Banknote Catalogue”, stated that "the number of varieties of [superscribed] notes issued, allowing for the possible basic differences in the note forms themselves, as well as the banks and the various denominations, is well over one hundred."

There are several reasons for this complexity:

- Unissued note forms from no less than fifteen different private banks were used as the basis of the superscribed note series;

- Five different denominations were issued within the superscribed series (£1, £5, £10, £50 and £100);

- Three different and quite distinct types of overprint were used while printing these notes over the three and a half year period between December 1910 and June 1914.

With all of these different factors in mind, we can perhaps forgive cataloguers and collectors for not coming to grips with the superscribed series as quickly as their historical importance warrants.

Not Covered by Popular Catalogues for a Number of Years

This complexity may well be another reason that Australia’s first Commonwealth notes were not included in the first comprehensive catalogue of Australian banknotes ever prepared - prepared by Syd Hagley and included in the fourth edition of “Renniks Australian Coin and Banknote Guide”, issued in 1966.

Subsequent catalogues of Australian banknotes released by Renniks and other publishers have slowly recognised the importance these notes have.

The Renniks guide quickly added a page of reference information on the superscribed notes shortly after 1966. This information was expanded upon by Mick Vort-Ronald in 1978 to cover the two distinct types of superscribed notes, while the 18th edition in 1998 was the first to include a comprehensive reference to the superscribed notes.

Superscribed Notes Circulated Alongside Treasury Notes for Some Time

The manner in which banknote catalogues are structured leads collectors to assume that certain series of banknotes are issued in discrete bursts - that one series ends before another one begins.

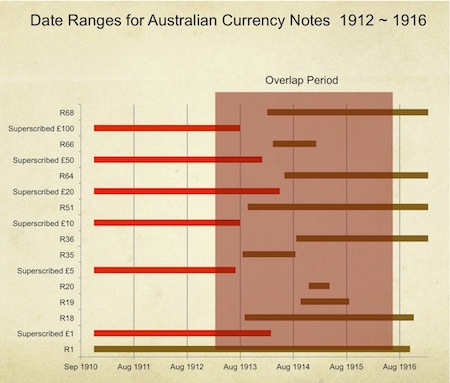

Research by two of Australia’s foremost banknote collectors, Dr Alan Nicholson and Mick Vort-Ronald, shows that not only do the superscribed notes precede the Treasury series notes by some three and a half years, but they continued to be issued until June 1914 - more than 12 months after the first Treasury notes were issued into circulation.

The following chart plots the periods over which all Australian Commonwealth notes were issued into circulation between 1910 and 1921 - it shows when both the superscribed notes and the Treasury series were first issued, and when they were replaced. As we can see, the period between September 1913 and June 1914 sees no less than 13 different notes on issue in Australia - seven superscribed denominations and six Treasury denominations.

As we can see from the chart, the one pound superscribed notes were issued at the same time as the new Treasury one pound notes for at least six months towards the end of 1913. Given what is known of the shortage of currency notes in the Australian economy at that time, it is highly likely that Teasury staff would not have insisted that the Type I superscribed notes were actively withdrawn from the banking system until late in 1915, when the Type II superscribed one pound notes began to be withdrawn.

With this likely overlap in circulation of up to six years in mind, we can see that, at the very least, the superscribed notes should be regarded as being quite equal in terms of their numismatic importance to the notes in the Treasury series.

Reasons For Government Control Over Notes Not Widely Known

One person that has written extensively on this subject is Stephen Bell, author of the book “Australia’s Money Mandarins: The Reserve Bank and the Politics of Money”: “The thrust of Labor’s critique of the private banks and of free financial markets was that they were too vulnerable to collapse, that the banks were profiteering, and that their lending practices tended to be pro-cyclical (excessive in an upswing and too restrictionist in a slump).”

Kevin Dowd is an expert on banking history (among other things), his book “Laissez Faire Banking” includes the view that the two Banknote Acts of 1910 were simply the first in a series of steps aimed at wresting authority and control over Australia’s monetary and banking systems away from private enterprise, and into centralised government hands.

Right or wrong, many Labour figures believed that as the Government would “only” be required to hold a reserve of gold sovereigns equal to 25% of the total value of the notes issued, the remaining 75% could be invested and thus provide the public with a modest income, or even further, could be used to fund public works.

This solution became even more appealing when the cost of funding those public works by borrowing the equivalent amount of money from London was considered.

Within 90 days of returning to power for the second time, Andrew Fisher’s Labour government passed two Acts that gave the Commonwealth a monopoly over the issue of notes in Australia, and thus began capturing “seigniorage revenue”.

Once the relevant acts of legislation were passed, the public service moved quickly to bring the new national notes into reality. As can be imagined, a new national currency at the very least requires specialised printing machinery, as well as other planks of infrastructure, none of which the Commonwealth Government had ready access to at that time.

These significant challenges were apparently dismissed out of hand by Treasury officials - rather than go to the time and expense of designing and printing the new notes from scratch (a project that would have taken several years at least to complete successfully), Treasury officials were instead quite prepared to “overprint” existing banknotes - to superimpose an official design, endorsement and denomination on banknotes that had already been printed by a private bank.

To put this strategy in perspective, overprinting is a strategy that is generally only been used by other governments around the world in times of war, hyper-inflation or other times of crisis. Other notable deployments of superscribed banknotes include:

- The overprinted “Dardanelles” notes issued to Australian and British troops serving in Gallipolli during World War I;

- High-value German notes re-issued during the hyper-inflationary days of the 1920’s.

- The “Hawaii” overprints issued by the US government following the attack on Pearl Harbour;

- The emergency notes issued by the British administration in Hong Kong between 1941 and 1945 (during and after WWII); and

It is therefore ironic that during Senate debate on the subject, the Labour Senator Gregor McGregor made the following statement in favour of proceeding with the Australian Notes Bill: “Is it not better for us to enact legislation of this character in times of quiet, when there is a complete absence of financial panic, and when no war cloud looms on the horizon to disturb our financial equilibrium, than it would be to enact it under the stress of financial panic, which may arise in the future as it has arisen in the past?”

The Labour Party therefore proposed that it was quite correct, and indeed vital to the national interest, to immediately use printing methods that until then had normally been reserved for times of emergency and crisis, precisely because no such emergency was presently taking place!

Correct Position in Australian Numismatics

I believe that the correct structure to a catalogue of Australian Commonwealth notes is that it should span from 1910 (the year in which the Act covering Australia’s currency notes was passed), and that the Type I superscribed notes should be shown as being the first type of each Commonwealth denomination issued.

The superscribed series of notes mark the definitive turning point between a system of currency notes facilitated by private enterprise, and one regulated by the Commonwealth government. As more collectors appreciate that the superscribed notes are the very first Australian notes issued by the people, for the benefit of the people, the market for these notes will surely reflect that.