January Market Report The 2026 Rollercoaster is Underway

Here we are at the end of the first month of the year, with some of us wondering what happened to the break we were supposed to have between Christmas and New Year!

No sooner do we down tools and relax than we're heading back to deal with the next thing and, well, now it's the end of the first month of the year.

E-commerce technology in 2026 allows a small enterprise like us to do business with folks right around the world - products that weren't economical to handle directly can now be sold relatively easily. We have more customers exponentially outside our local area than we do around us, but that means our annual rhythm of activity also has to be non-traditional.

Boxing Day Traffic Was 25% Up, January Went On From There

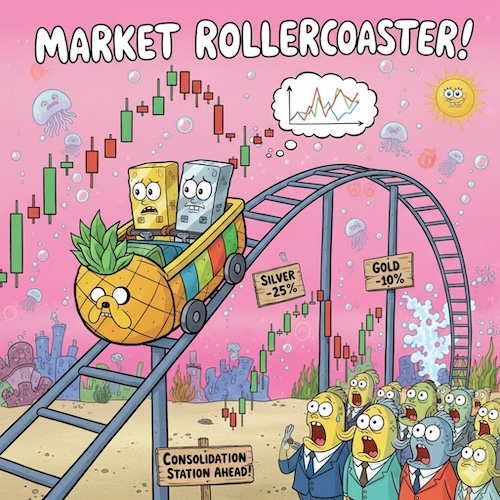

The Rollercoaster That Is 2026

Image Source: Google Nano Banana

As a quick example, traffic on our website on Boxing Day was 25% above the daily average. We attended our regular local show here in Perth the day after Boxing Day, all of which in practical terms meant we had a swag of orders to send out the first working day back.

Annual leave also allows some of us the space to finally get to those pesky tasks we've been meaning to get to all year. For folks who are responsible for a large collection of coins or notes, it means they can finally start to learn about the way the market works, make contact with professionals who look like they might be able to help and take some action.

We've bought more than a dozen 5-figure collections so far this year and a few larger than that. Nearly all of that new inventory is now online, a good portion of it has already sold.

So the Australian market for coins and notes is as active as it's ever been. While a lot of that activity is being driven by the current buoyancy in precious metals, we're still active with notes as well.

Prices for the metals are whipsawing around like a rollercoaster - we saw a drop of 25% in silver just last night, while gold "only" came off around 10%. Such price movements can be challenging for those looking to make short-term decisions, and even more challenging for those who don't really understand the market but are following for the first time. That adjustment has probably brought the market back to a level where it can consolidate for a time before making its next move.

New York In the Middle of the Bedlam - A Learning Experience

AI-Generated NY Bourse Image

Image Source: Google Nano Banana

In the middle of this bedlam, we extricated ourselves from the office for two weeks to head to the United States. Our first week was spent in Manhattan (New York), thankfully just before a major cold snap hit. The New York International Coin Convention is arguably the most exclusive coin show in the world. Not the largest, but arguably the most exclusive. I've been meaning to head to this for years, and finally got to putting our name down on the wait list for a booth early in November. We were advised by the organiser he'd get in touch if anything became available, which I thought was the end of that. I must remember to be careful what I wish for, because late in December I received an email that a booth was available. Hurried bookings for flights, hotels and customs agents followed, and we were off.

If you're wondering how it went, my answer will depend entirely on whether I'm in my growth mindset or my fixed mindset. If I'm in my fixed mindset, I'll say it was a disaster - any mistake I could have made leading into this event, I made it. That's not close to being true, but will say it was a learning experience. Customs compliance was a prime consideration, and while we were able to sail through without concern, dang it was expensive!

Australia in the Wider World - Acknowledged and Appreciated

Our time in New York affirmed what I already knew, that the Australian market is acknowledged around the world, but we really make up only a modest fraction of what is available to collectors across the globe. One of the featured collections offered across the week was The Regent Collection, formed by a leading figure in Australian numismatics and including some of our most important numismatic rarities. I understand from the trade that the two Adelaide Ingots were acquired by an active US collector (who founded Google no less), while at least one of the gold patterns was acquired by a long-standing US dealer in world gold coins, not for a client but just because he digs it!

Perth to the World

Keep in mind that the coin sold for close to A$200,000, and you get an idea of the size of the money pool that is the international market for numismatic gold coins - it is a whole other level. I don't know an Australian dealer who has the wealth to keep a $200k item that sits well outside their normal inventory library just because they think it's neat. If anything, I know several dealers who exited the business completely because ego got in the way of disciplined inventory management.

Don't get me wrong, there are collectors in our professional coterie who acquire items with their own tastes in mind first and commercial considerations next, but not to that level. I understand the Google founder has been working on a collection for some time, for it to be complemented by two of our nation's most important numismatic rarities speaks to the value, size and scope it must have.

We'll be back in Manhattan next year, flying the flag and wiser for our 2026 exercise.

The Outlook for 2026 - Increased Interest and a Need for Consolidation

So how does 2026 look? I see no reason for any negativity at the moment, even if some areas need to be consolidated before they make progress.

Despite the apparent anointment of the new Federal Reserve chair overnight, I don't see the structural causes for the rise in interest in precious metals changing any time soon. That buoyancy is reflected across tangible assets, I'm unequivocally seeing more interest in meaningful items like quality ancient and foreign coins, as well as quality foreign notes. That is a level up over where we've been in the recent past, and is in addition to the bread-and-butter decimal coins and notes we trade in most often.

Just yesterday, I spoke with a young guy who visited us to collect an online order. He comfortably said he'd been blown up twice by trading in crypto, and was now hankering for assets he can actually put his hands on. Learning about the basic silver items he was starting with was leading him to learn about history and economics as a byproduct of his due diligence.

So there's hope for the numismatic market in the post-cash world! Some areas of the market do need to consolidate - there are so many opportunities about at the moment that those folks who are operating on an understanding of what the market used to be like, who want to dig in and hold out for what they think they should get, they'll miss the trend and will be disappointed the most.