Noble Numismatics Auction 104 - Australia’s Last Major Numismatic Auction For 2013

With a declared turnover of $2.34 million over 4 days, Noble 104 was without doubt a decent sized event.

As a dealer, I never know what is going to be included in these sales - Noble’s handle so much of such a wide range of numismatic material that I need to be prepared for pre-decimal notes, gold coins, foreign notes or even ancient coins.

This sale perhaps didn’t feature a huge number of earth-shattering rarities, however there was enough in each section to keep me satisfied. The addition this time round of an online bidding facility makes me wonder if it is going to be necessary next time to stay in Sydney for the entire week, with some tweaking I don’t believe it will be.

It will always be vital to view items before bidding on them, then there is the small matter of payment and collection, however all things considered, we can see that technological changes continue apace in the numismatic industry.

The Early Sessions

The sale itself kicked off as it always does, with the inexpensive lots of decimal and pre-decimal coins, as well as bulk lots, errors, medallions and tokens.

Prices for decimal NCLT coins (that is, the boxed products both of our mints make to sell to collectors) continue to ease.

Just what the cause of this isn’t clear - other areas are doing well, however belt coins sure aren’t strong at the moment. . If you have some proof sets or individual coins from either the Perth Mint or the Royal Australian Mint, and have been meaning to get around to selling them, I wouldn’t put the task off as the market is continuing to come off the boil.

The bulk lots are always well picked over these days, the error and variety coins received the enthusiastic attention they always do. Medallions and tokens are both specialised fields, collectors active in those areas (as both buyers and sellers) tend to be very well informed regarding the values of the items they have an interest in, so that market ticks along at a steady pace.

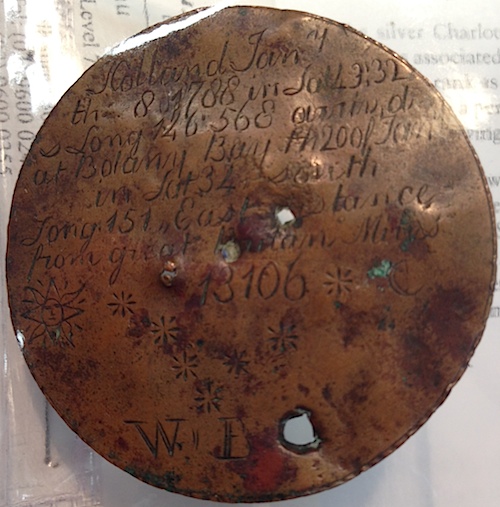

The Feature of the Sale - The Charlotte Medal in Copper

The feature of the entire sale was the “Charlotte” medal in copper - so named because it was engraved on the Charlotte, one of the ships in the first fleet to reach Australia’s shores in 1788. It is an incredibly historic item - not only is it thought to have been engraved on copper literally pulled from the hull of the Charlotte(how cool is that), it was engraved while the ship was moored in Botany Bay, just prior to the first landing on January 26th, 1788.

As a direct and tangible link to the very first people that settled our nation, the Charlotte medal has to be of unparalelled historical importance. It may not be the most attractive item of Australiana available, however it is certainly exclusive and without paralell in private hands.

When I was in the room watching the bidding for this item, I thought that it had sold at a hammer price of $350,000. It turns out that was effectively a vendor bid, and that the level of interest on the day didn’t push the item up above it’s reserve. If I were the owner of such a historical and irreplacable item, I don’t expect I’d be particularly flexible with my asking price either.

I understand the vendor has a particular value in mind for the item, so it will be interesting to see when it appears available for sale again any time soon.

The Tuesday Evening Session - Australian Coins

The evening session of the Australian coins was notable for two reasons - it included no less than 8 examples of the historic and rare 1813 Fifteen Pence from colonial NSW (plus 2 contemporary counterfeits), and a small number of attractive pre–1955 proofs at extraordinarily low estimates.

The 8 genuine dumps ranged in grade from good Fine to good Very Fine, with reserves that I felt were just shy of where they needed to be if they were to find a reasonable number of ready buyers. True to form at the moment, there was just 1 bid across the 8 coins, leaving 7 passed in and just one sold.

While certain collectors are quite prepared to pay premium prices for the highest quality colonial NSW coins available, the average collector seems to be demanding extra-ordinary value before they’ll part with cash for one that doesn’t meet that high benchmark.

Type II Adelaide Pounds

The gold coins included a number of 1852 Type II Adelaide Pounds, one of them seemingly under-graded by the auctioneer (as many have done with premium examples of this coin in recent years). The price realised for this coin was a fraction of the current catalogue value, albeit a decent fraction. There weren’t too many surprises within the rest of the gold coins - they sold within expected ranged for their grade and type.

Pre-1955 Pre Decimal Proofs

The key items within the pre–1955 proofs were a pair of 1935 copper coins (penny and halfpenny). These Melbourne Mint proofs are often seen with a deep chocolate patina, with carbon patches or a disparate tone. The two examples in this sale were attractive - nice red lustre, and devoid of the problems that many comparable coins have.

The coins did certainly attract some interest, however they perhaps sold for less than quality pairs have made in a long, long time - around $18,000 and change. Subdued prices for pre–1955 proofs have in recent years been largely explained by the quality (or lack thereof) of the items on offer, however that convenient explanation couldn’t be used for this pair. My research into auction results shows me that you’d need to go back to 2003 to see an auction result for an unimpaired pair close to this figure.

I don’t believe there will be too many vendors keen to test the market at these price levels, meaning quality inventory will either remain off the market until values recover, or we may well find ourselves resetting agreed values at this level.

Just whether this result turns out to be the incredible bargain it presently seems to be, or just the first trade in a series of exchanges at this level, remains to be seen.

There were a number of QEII proofs within this sale, they remain popular with a range of bidders, both collectors and from the trade, indicating that it is healthy and liquid market at a price.

The PCGS Registry Set and "Mad" Money for a Few 1934/5 Florins

The most remarkable result within the Commonwealth coins were the premium prices paid for a small number of Melbourne Centenary florins. With the advent of PCGS grading and the PCGS set registry, there’s been a huge increase in the number of collectors that see merit in paying ever-higher prices for coins in premium grade. If you’re not already aware, circulation-strike Centenary florins in top quality have traded for between $4,000 and $5,000 - a few of the coins in this sale reached those levels as well. While I can understand a collector paying a premium price for a coin in a PCGS slab with a high number on it, it’s quite another thing to see dealers going toe to toe into unprecedented price territory on raw coins.

Of the two Centenary florins that made “mad” money, the highest brought a nett result of $5,962.50, with another making $4,770 nett. So, while there are certain sections of the Australian numismatic market that are subdued, that certainly isn’t the case for the entire market. I didn’t see too many other results within the Commonwealth coins that were too remarkable. The 1930 pennies included in this sale weren’t particularly attractive for the money on ask in my opinion, yet they made solid results regardless.

British Coins from Kign George III to King George V

The Wednesday sessions included a range of British coins that were the best I’ve seen in Australia for some time - we always seem to have the odd coin or two in nice quality on offer, however it is very seldom that we see a comprehensive collection that’s been put together with an eye for quality. I felt the coins made reasonable prices relative to what they would have made if they’d been offered in the UK, and was pleased to pick up a range of them for our own inventory.

British coins struck between the reigns of King George III and King George V were all used here in Australia, so have a lot of relevance to Australian collectors. They are beautiful and scarce in top quality, feature impressive designs and in many cases are extremely affordable to many Australian coppper and silver coins struck a century later.

Thursday - Australian Banknotes

The banknote sessions really didn’t include a lot of quality material that was ever going to test the market. Those few items that were in premium quality were clearly reserved above the current market, and were passed in as a result. That said, the clearance rate in these sessions was quite good, although perhaps not at price levels collectors with a mind to sell rather than buy would like. Again, this shows to me that the market for Australian notes is actually working OK, prices just need to be at a level incoming buyers see as being good value for money.

2014 should be an interesting season for us all in the Australian numismatic market - I understand the inventory of the now-in-liquidation Rare Coin Company will be offered for sale via auction in the first few months of the year, this coudl play a role in setting the tone for the short term. I’m also aware that there isn’t a huge amount of duplicated material in that inventory that is going to “crash” the market any time soon, so it could be a bonanza for cashed-up buyers that have confidence in these assets and are prepared to back themselves.