The Federal Bank of Australia - “The Most Famous And Most Notorious Of All Boom Institutions”

The 2018 Banking Royal Commission has caused a great deal of debate within Australia's political parties and the general public over just how Australia's banking system should be designed to ensure the safety of the average bank depositor.

Those discussing the issues at hand will be interested to learn of the history of the Federal Bank of Australia in the late 1800's, and the failed attempt by the "Associated Banks of Victoria" to enforce effective separation in the Australian banking system.

The narrative of the Federal Bank of Australia mirrors the incredible wealth that was generated during the land boom seen in Melbourne in the late 1800’s. Unfortunately for the bank’s directors; investors and depositors, their demise also exemplified the crushing cost of the banking crisis of 1893 that followed. The Federal Bank of Australia has been described by one historian as being “The most famous and most notorious of all boom institutions.” 1

Marvelous Melbourne’s Land Boom of the 1880’s - Unparalleled Wealth

Melbourne witnessed an extraordinary boom in real estate prices throughout the 1880’s that was as strong and as intoxicating as the boom in cryptocurrencies seen across 2017. By 1889, the value of land in central Melbourne was as high as it was in London. 2 The most successful entrepreneurs in the land boom era controlled a network of land banks, mortgage companies and building societies, all discreetly linked behind the scenes.

The Federal Bank of Australia - “The Most Famous And Most Notorious Of All Boom Institutions”

The Federal Bank of Australia was established by a Scottish businessman and politician, James Munro. Munro was a printer by trade, and happened upon the idea for a career in banking when printing the regulations for a building society. Munro had seen first-hand the commercial success that building societies in his native Scotland had enjoyed, and was convinced that a public building society set up on a slightly different model would work well in Victoria. Shortly afterwards in 1865, Munro established the Victorian Permanent Building Society. 3

Outside his commercial pursuits, Munro was deeply involved in the temperance movement in Victoria. That involvement led to him being elected in 1874 to the Victorian Legislative Assembly as the member for North Melbourne. In 1876, Munro built a grand family home named “Armadale House” at 117 Kooyong Road in the suburb now known as Armadale.

Throughout the 1880’s, Munro channeled his entrepreneurial drive towards his moral agenda by establishing several “coffee palaces” in central Melbourne. These grand establishments, with their incredible size and ornate architecture, might best be described today as hotels that did not serve alcohol. Most coffee palaces did not survive the depression that followed the boom, however the Grand Coffee Palace on Spring Street survives today as the Windsor Hotel.

The Federal Coffee Palace, was another of Munro’s establishments, with 370 guest rooms it ranked as one of the largest hotels in Australia. Designed in the French Renaissance style, the façade was embellished with statues, griffins and the goddess Venus in a chariot drawn by four sea-horses. The interior featured chess, billiard, reading, smoking, writing and sitting rooms, six “accident proof” lifts, gas lighting, electric service bells and an ice-making plant.

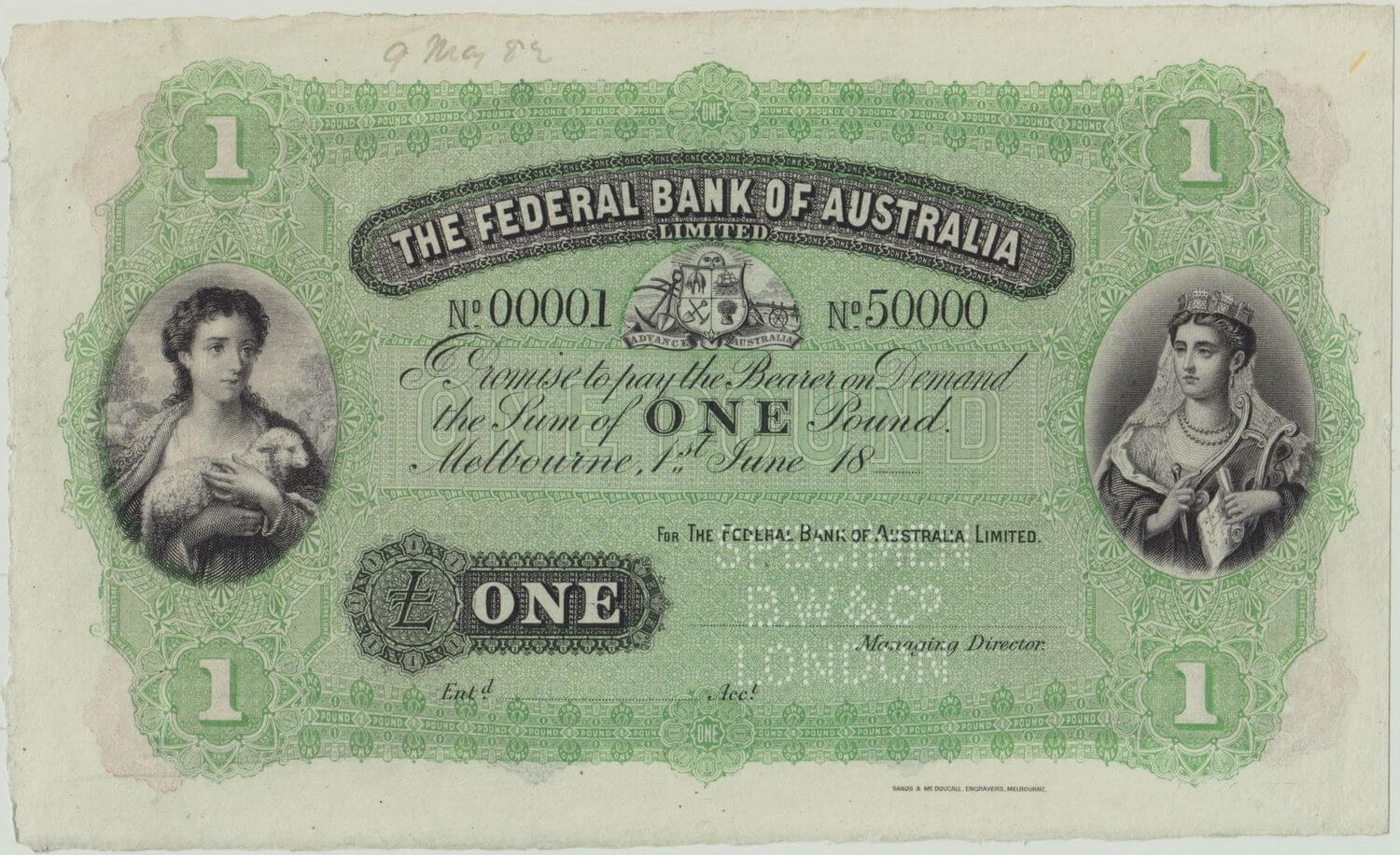

In 1881, Munro parlayed his profile as a temperance leader and politician together with his commercial success with the Victorian Permanent Building Society and his coffee palaces into two much larger enterprises - The Federal Bank of Australia and the Federal Building Society.

The Federal Bank of Australia and the Federal Building Society

Munro assumed the role of Managing Director of the Bank, and appointed his son Alexander as the Secretary of the Building Society. Thousands of small depositors opened accounts on the strength of Munro’s standing in the community and their shared hopes for a prosperous future. Munro and his colleagues showed incredible foresight with their initial property purchases - they acquired undeveloped land in exactly those areas Melbourne’s new railway network was extended into. Land values rose strongly in the years that shortly followed - Munro’s nett worth was estimated to be £250,000 prior to the end of the boom. In the intervening years, the Federal Bank of Australia regularly paid strong dividends to investors. The boom in land values and shares in the companies developing it lasted as long as there was confidence in the future.

Once credit growth slowed and confidence stalled however, the boom quickly collapsed into an economic depression that economists state was far worse and lasted far longer 4 than the Great Depression.  In 1887, Munro established yet another financial entity named “The Real Estate Bank” to ostensibly better manage his personal real estate affairs.

In 1887, Munro established yet another financial entity named “The Real Estate Bank” to ostensibly better manage his personal real estate affairs.

A Network of Financial Institutions

The Associated Banks of Victoria foresaw the potential for conflicts of interest when significant investors in the real estate boom controlled or were associated with multiple financial institutions, and so in 1889 passed a regulation excluding banks that had any ownership of a Building Society. Shortly after that regulation was passed, the Federal Bank of Australia sold the 130,000 shares it held in the Federal Building Society.

Munro had met the requirements on paper, however many remained concerned that was not matched in reality. Property prices in Victoria collapsed in 1889, this led to a spate of building society failures in 1890. Once it became clearer that the fall in property prices was not just temporary, the financial collapse spread to the land banks. As the number of failures and frauds grew over time, public confidence in all financial institutions faltered, which spread the crisis to the institutions at the core of the financial system - the banks that issued their own notes. 5

Munro became Premier of Victoria just as this financial maelstrom was unfolding, on November 5th, 1890. One regulatory bill passed during his tenure was the Voluntary Liquidation Act, assented on December 3rd 1891. This act was represented by the government as a measure to ensure the financial system remained stable during a period of turmoil.

Critics of the bill however suggested that its true purpose was instead to enable disreputable and badly managed businesses to avoid the full consequences of their actions. That theory was lent some weight when Munro’s Federal Building Society suspended payments to depositors the day after the bill was passed, the Real Estate Bank followed suit on December 15th. 6

Although the Federal Bank of Australia was a member of the respected Associated Banks of Victoria 7, it was regarded as being the “smallest and weakest” bank in that group. Many members of the general public remained so concerned with the links apparent between the Federal Bank and Munro’s other troubled entities that the bank lost a third of its Australian deposits 8 in the 10 months prior to January 1893.

The Final Phase - Suspension of Payments and Resignation as Premier

The final phase in the history of the Federal Bank of Australia began on January 30th 1893, when it was also forced to suspend payments to depositors. Munro stood down as Premier of Victoria on February 16th, the Real Estate Bank entered liquidation just 3 days later. Munro declared bankruptcy in February, his debts amounted to £97,000. That debt would have been far higher if the Federal Bank had not released him from his debt to them of £125,000 just four days before it closed. The extent of Munro’s related party dealings only became truly clear when the accounts of his various entities were audited in the months that followed. Auditors of the Real Estate Bank showed cash losses that totalled £1,027,000.

The solicitor George Godfrey led a number of investigations into the activities of boom companies, and alleged that £180,000 had been paid by the Real Estate Bank to Munro for several worthless properties. We can see that if those two related-party transactions had not been entered into, the true level of Munro’s personal debt would have amounted to £397,000 at the very least, excluding any other related-party transactions that may have taken place.

Allegations of more of the creative accounting practices that the Federal Bank’s directors and staff had entered into in order to keep the bank afloat came to light during the subsequent court case. Evidence was presented that showed Munro had lent himself, his family and friends close to a million pounds in public funds via the Federal Bank.

Munro’s villainous standing in the community after the collapse of his various financial institutions was captured in the events of April 17th 1893, when he was physically attacked by an aggrieved depositor of the Federal Bank on Collins Street, not altogether far from the bank’s headquarters at 307 Collins Street.

George Davis was described as “a tall and powerfully built builder’s labourer” who had lost his life’s savings with the collapse of the Federal Bank. Although several versions of the incident were recalled by victim, the defendant and the various witnesses that were called before the court, it was agreed that Davis attempted to speak with Munro on Collins Street, and was pushed away. Davis then knocked Munro out with a single punch to the head, and was restrained by several passers-by. The court found Davis guilty of assault, and fined him either £5 or a month in prison.

Davis was surprised to learn that the fine had been anonymously paid on his behalf before he had even left the courtroom - whether this was by a fellow disgruntled customer of the Federal Bank of Australia was the subject of some media discussion in the days that followed. The Land Boom that unfolded in Melbourne throughout the 1880’s and erupted into the Depression of 1893 was an episode of unparalleled wealth in Australian history.

James Munro was arguably the highest profile member of the Melbourne business community during the headiest days of the land boom, the Federal Bank of Australia rode the boom for all it was worth. Although Munro’s wealth didn’t survive the Depression intact, the Windsor Hotel on Spring Street; Armadale House on Kooyong Road and the notes of the Federal Bank of Australia are exclusive and lasting reminders of the heady days of “Marvelous Melbourne”.

1 Cannon; Michael, "The Land Boomers", Melbourne University Publishing, Melbourne, 1967, p .

2 https://collections.museumvictoria.com.au/articles/2676

3 Cannon; Michael, "The Land Boomers", Melbourne University Publishing, Melbourne, 1967, p .

4 Fisher and Kent; , "Two Depressions, One Banking Collapse" in the "System Stability Department, RBA", June 1999, p 3.

5 Bryan Fitz-Gibbon and Marianne Gizycki; , "A History Of Last-Resort Lending And Other Support For Troubled Financial Institutions In Australia" in the System Stability Department Reserve Bank of Australia, 2007-07, October 2001, p 22.

6 https://collections.museumvictoria.com.au/items/1206559

7 Bryan Fitz-Gibbon and Marianne Gizycki; , "A History Of Last-Resort Lending And Other Support For Troubled Financial Institutions In Australia" in the System Stability Department Reserve Bank of Australia, 2007-07, October 2001, p 24.

8 Bryan Fitz-Gibbon and Marianne Gizycki; , "A History Of Last-Resort Lending And Other Support For Troubled Financial Institutions In Australia" in the System Stability Department Reserve Bank of Australia, 2007-07, October 2001, p 24.